Meaningful Legacy Through Planned Giving

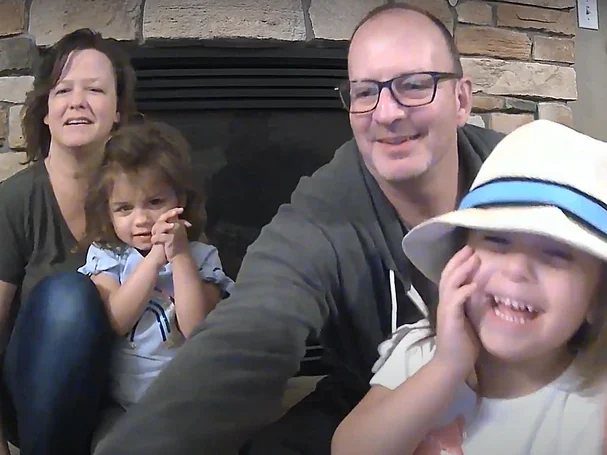

You are a person who cares deeply for children who have been abused and neglected. Did you know a planned gift from your estate can leave a meaningful legacy? You will help children become resilient for generations to come.

Donors like you make it possible for Pathway to continue providing foster care, adoption, and mental health services for children and families who need it the most.

Pathway Caring for Children is a private, non-profit 501(c)(3) organization recognized by the IRS, EIN# 23-7244648. All gifts are tax-deductible to the extent allowed by law.

In the words of Pathway founder Jim Bridges, “I count myself as one of the most fortunate people in the world because I have been able to see my dreams come true. That’s something that does not happen to most people. That long ago vision—to provide places where foster children can live through their problems with people committed to them—is happening every day now at Pathway.”

You can choose how you will make the greatest impact with your planned giving and take advantage of tax benefits:

Gifts in your will or trust (bequests) – Simply designate Pathway Caring for Children in your bequest to give a specific dollar amount or a percentage of your estate. This will not affect your cashflow during your lifetime and is easy to revoke if your situation changes.

Retirement plan – lifetime gifts – If you are 70½ or older, you can transfer up to $100,000 each year directly from your IRA to Pathway Caring for Children and not recognize it as income. It also counts toward your minimum required distribution from the IRA for the year.

Securities – Stocks and publicly traded securities offer numerous tax advantages and can be more beneficial than giving cash. You can:

- Transfer the stock to Pathway Caring for Children electronically through your broker, or

- Send the stock certificate and a signed stock power for each certificate to us separately through the mail.

Adding Pathway Caring for Children is simple – talk to your financial advisor for assistance. Or contact Pathway’s Community Engagement Director, Deborah Garrott at 330-493-0083 or [email protected]. We’re here to help you do the most good for children in our community.

Thank you for doing your part in changing the lives of children for years to come. We invite you to become part of Pathway’s story through your legacy.

Disclaimer: Pathway Caring for Children does not provide legal, financial, tax compliance, or other professional advice to donors. Donors should seek the assistance of personal legal counsel or other advisors in matters relating to the legal, tax, and estate planning consequences of the proposed gift.